Business

Why is Bitcoin price up Today? – Crypto News

Bitcoin (BTC) price rose 4% to reclaim the $97,000 on Thursday, driven by positive tailwinds from US and Russia resuming diplomatic relations. Will Michael Saylor’s imminent BTC purchases and ETF filing speculation drive Bitcoin price rebound above $100,000 in the days ahead?

Bitcoin Reclaims $97,000 as Trump Signals Russia-Ukraine Ceasefire Talks

Bitcoin’s price rebounded sharply on Thursday, gaining 4% to reclaim the $97,000 level amid renewed optimism surrounding U.S.-Russia diplomatic engagement. This shift follows reports confirming that Washington and Moscow have resumed diplomatic talks, potentially laying the groundwork for a resolution to the ongoing Russia-Ukraine war.

Market sentiment had deteriorated last week after hotter-than-expected U.S. CPI data reinforced expectations of prolonged Federal Reserve tightening. Investors reduced BTC exposure in anticipation of further rate hikes, triggering a pullback to $93,388. However, geopolitical developments appear to have offset these concerns.

Reuters reported on Feb. 18 that U.S. and Russia had agreed to reopen diplomatic communications channels, triggering positive reactions across global financial markets. Bitcoin price mirrored the risk-on sentiment, rallying 4% within 24 hours of the announcement.

With market confidence improving, BTC price trajectory now hinges on continued geopolitical de-escalation and investor positioning ahead of key economic data releases.

How Will Bitcoin React to a Russia-Ukraine Ceasefire?

Geopolitical risk has played a significant role in Bitcoin’s volatility since 2022, with the Russia-Ukraine conflict contributing to inflationary pressures and market instability. However, a potential ceasefire could reshape global economic conditions, particularly regarding energy prices, trade flows, and regulatory policy.

While major political voices in Europe and the UK called for further funding to support Ukraine’s defense, crypto bettors on the predictions market platform Polymarket have priced in a 67% chance of a ceasefire between Ukraine and Russia in 2025. This confirms that majority of market watchers are anticipating a ceasefire in the coming months.

A de-escalation scenario could lead to the lifting of economic sanctions, the reopening of critical trade routes, and an increase in Russian oil and gas exports. This would likely reduce energy-driven inflation, reinforcing the case for less hawkish Fed tweaks in the coming months.

Beyond macroeconomic factors, crypto market dynamics could shift as well. A relaxation of financial restrictions may allow Russian investors to re-enter global crypto markets, increasing Bitcoin’s demand. Additionally, a more stable geopolitical backdrop may encourage institutional capital inflows into digital assets, particularly as ETF-driven adoption gains momentum.

With the ongoing 4% BTC price rebound fueled by both geopolitical optimism and institutional accumulation, traders will closely watch upcoming developments for confirmation of a ceasefire. If positive momentum continues, BTC could break through $100,000, testing key resistance levels in the days ahead.

Notably, Michaell Saylor-led firm Strategy, (formerly known as Microstrategy) has announced a decision to raise another $2 billion in debt instruments to fund additional BTC purchases. With altcoin ETF filing nearing approval, an end to the Russian vs. Ukraine could spark the next wave of institutional-driven rally for top-ranked cryptocurrencies including BTC.

Bitcoin Price Forecast: Multi-day Closes Above $98,000 Could Mark Local Bottom

Bitcoin price forecast chart below shows BTC hovering near $97,000, rebounding from the lower Bollinger Band ($94,339) as buyers regain control.

The recent two-day rally of 3.78% suggests a potential bottoming pattern forming around the $94,000-$96,000 range. However, a definitive shift in momentum hinges on BTC securing multiple daily closes above $98,000, aligning with the mid-Bollinger Band and key resistance zone.

The Relative Strength Index (RSI) at 46.66 remains below the neutral 50 level, indicating weak bullish momentum but potential upside if it crosses above its signal line (44.16). A confirmed RSI breakout could accelerate BTC’s move toward the psychological $100,000 mark.

Conversely, failure to reclaim $98,000 may trigger another retest of the $94,000 support, with deeper downside risk toward $92,000 if sellers strengthen.

Volume analysis highlights rising accumulation, with a notable 41.44K BTC traded over the last two days, reinforcing buying interest near current levels.

If geopolitical optimism persists and Bitcoin ETFs maintain steady inflows, bullish continuation remains the favored scenario. However, traders should remain cautious of short-term profit-taking near resistance.

Frequently Asked Questions (FAQs)

Bitcoin must break and close above $98,000 to confirm a local bottom and sustain bullish momentum.

If BTC faces rejection near $98,000 and volume declines, a retest of $94,000 or even $92,000 remains possible.

A ceasefire could improve market sentiment, reduce inflationary pressure, and attract institutional capital to Bitcoin.

<!–

–>

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Technology1 week ago

Technology1 week agoChip Designer Arm Plans to Become Chip Manufacturer – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoSUI eyes 24% rally as bullish price action gains strength – Crypto News

-

others6 days ago

others6 days agoJapanese Yen remains depressed amid modest USD strength; downside seems limited – Crypto News

-

Technology1 week ago

Technology1 week agoMacBook Air M3 15-inch model gets a ₹12,000 price drop on Amazon: Deal explained – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoCoinbase scores major win as SEC set to drop lawsuit – Crypto News

-

others1 week ago

Japan Foreign Investment in Japan Stocks declined to ¥-384.4B in February 7 from previous ¥-315.2B – Crypto News

-

Technology1 week ago

Technology1 week agoPerplexity takes on ChatGPT and Gemini with new Deep Research AI that completes most tasks in under 3 minutes – Crypto News

-

Technology1 week ago

Technology1 week agoLava Pro Watch X with 1.44-inch AMOLED display, in-built GPS launched in India at ₹4,499 – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Set To Outshine Gold? Analyst Predicts 1,000% Surge – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAdvisers on crypto: Takeaways from another survey – Crypto News

-

others1 week ago

others1 week agoRemains subdued below 1.4200 near falling wedge’s lower threshold – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago0xLoky Introduces AI-powered Intel for Crypto Data & On-chain Insights – Crypto News

-

Technology1 week ago

Technology1 week agoFactbox-China’s AI firms take spotlight with deals, low-cost models – Crypto News

-

Technology1 week ago

Technology1 week agoMassive price drops on Samsung Galaxy devices: Up to ₹10000 discount on Watch Ultra, Tab S10 Plus, and more – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTether Acquires a Minority Stake in Italian Football Giant Juventus – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP To 3 Digits? The ‘Signs’ That Could Confirm It, Basketball Analyst Says – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar jumps to highs since December on USD weakness – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: JioHotstar launched, Sam Altman vs Elon Musk feud intensifies, Perplexity takes on ChatGPT and more – Crypto News

-

Technology1 week ago

Technology1 week agoWhat will it take for India to become a global data centre hub? – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT vs Perplexity: Sam Altman praises Aravind Srinivas’ Deep Research AI; ‘Proud of you’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoNEAR Breaks Below Parallel Channel: Key Levels To Watch – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoWill BTC Rebound Or Drop To $76,000? – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoXRP Price Settles After Gains—Is a Fresh Upside Move Coming? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoHow AI will divide the best from the rest – Crypto News

-

Business6 days ago

Business6 days agoWhat Will be KAITO Price At Launch? – Crypto News

-

Business6 days ago

Business6 days agoElon Musk’s DOGE Launches Probe into US SEC, Ripple Lawsuit To End? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Price Pulls Back From Highs—Are Bulls Still in Control? – Crypto News

-

Business5 days ago

Business5 days agoWhales Move From Shiba Inu to FXGuys – Here’s Why – Crypto News

-

Technology1 week ago

Technology1 week agoBest phones under ₹20,000 in February 2025: Poco X7, Motorola Edge 50 Neo and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoPopular Investor Says Memecoin More Superior With ‘World’s Best Chart’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWho is Satoshi Nakamoto, The Creator of Bitcoin? – Crypto News

-

Technology1 week ago

Technology1 week agoGrok 3 is coming! Elon Musk announces launch date, promises ‘smartest AI on Earth’ – Crypto News

-

Technology7 days ago

Technology7 days agoUnion Minister Ashwini Vaishnaw to launch India AI Mission portal soon, 10 companies set to provide 14,000 GPUs – Crypto News

-

others6 days ago

others6 days agoForex Today: What if the RBA…? – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoHayden Davis crypto scandal deepens as LIBRA memecoin faces fraud allegations – Crypto News

-

Technology5 days ago

Technology5 days agoLuminious inverters for your home to never see darkness again – Crypto News

-

Technology3 days ago

Technology3 days agoStellantis Debuts System to Handle ‘Routine Driving Tasks’ – Crypto News

-

Technology1 week ago

Technology1 week agoCyber fraud alert: Doctor duped of ₹15.50 lakh via fake trading app; here’s what happened – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto narratives as we await next market move – Crypto News

-

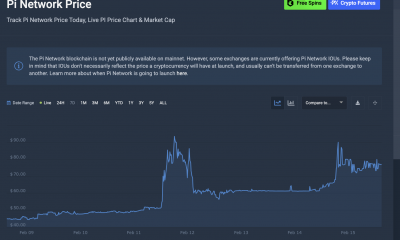

Business1 week ago

Business1 week agoHow Will It Affect Pi Coin Price? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGameStop Stock Price Pumps After Report of Bitcoin Buying Plans – Crypto News

-

Business6 days ago

Business6 days agoThese 3 Altcoins Will Help You Capitalize on Stellar’s Recent DIp – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoBitcoin Sees $430M in Outflows as Market Responds to Fed’s Hawkish Stance – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoStrange Love: why people are falling for their AI companions – Crypto News

-

Technology1 week ago

Technology1 week agoJioHotstar streaming platform launched, merging content from JioCinema and Disney+ Hotstar – Crypto News

-

Technology1 week ago

Technology1 week agoFormer Google CEO warns of ‘Bin Laden scenario’ for AI: ‘They could misuse it and do real harm’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoYap-to-earn takes over Twitter – Blockworks – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSomeone Just Won $100K in Bitcoin From a $50 Pack of Trading Cards – Crypto News

-

Technology1 week ago

Technology1 week agoSay goodbye to tangled cables: Stylish magnetic power banks keep your iPhone or Android charged on the go – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI board unanimously rejects Musk’s $97.4 billion takeover bid: ‘Not for sale’ – Crypto News

✓ Share: