others

WTI falls on Asia’s earthquake worries fading amid a softer USD – Crypto News

- Oil installations around Turkey and Syria had reported no or minor damages, which capped WTI’s drop.

- Fed hawkish commentary capped WTI’s rally toward $80.00.

- WTI Price Analysis: To remain down biased, eyeing $73.00.

WTI creeps lower after testing weekly highs around $78.80 and drops toward the $77.70 area on Thursday amid further hawkish Fed speaking pushing back against Fed Chair Powell’s comments on Tuesday. In addition, speculation of damages to oil infrastructure following an earthquake in Turkey and Syria faded, which remained intact. At the time of writing, WTI exchanges hands at $77.63 per barrel.

Worries about an earthquake that hit Turkey and Syria at the beginning of the week, which has killed more than 19,000 people, was a tailwind for US crude oil prices amid growing concerns about damaging pipelines and oil infrastructure. Even though spurred a shut off for a few days, sources cited by Reuters said “We won’t be losing that supply for as long as we thought.”

An additional factor that undermined oil prices was a stunning jobs report in the United States (US), keeping investors unease amid speculation that the US Federal Reserve would continue to tighten monetary conditions aggressively to an already slowing economy.

Meanwhile, the prospects of solid demand from China, amid its relaxation of Covid-19 measures, backed WTI prices, as reports showed that Chinese oil consumption would increase crude output by 1 million barrels a day.

That said, WTI’s snapped three days of consecutive gains, peaking around the 50-day EMA at $78.69, exacerbating a fall to the 20-day EMA at $77.71.

WTI technical analysis

Technically speaking, WTI prices appear to have peaked at around the 50-day EMA during the current week. Even though oil is printing a hanging man, a bearish signal, it’s also in the process of forming a bearish engulfing candle pattern, which would trigger a stronger downward reaction that could lower prices.

Therefore, WTI’s first support would be $77.00 PB. A breach of the latter and oil prices will aim towards the February 7 daily low of $74.40, ahead of the weekly low of $72.30.

-

Technology1 week ago

Technology1 week agoChip Designer Arm Plans to Become Chip Manufacturer – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoSUI eyes 24% rally as bullish price action gains strength – Crypto News

-

others6 days ago

others6 days agoJapanese Yen remains depressed amid modest USD strength; downside seems limited – Crypto News

-

Technology1 week ago

Technology1 week agoMacBook Air M3 15-inch model gets a ₹12,000 price drop on Amazon: Deal explained – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoCoinbase scores major win as SEC set to drop lawsuit – Crypto News

-

others1 week ago

Japan Foreign Investment in Japan Stocks declined to ¥-384.4B in February 7 from previous ¥-315.2B – Crypto News

-

Technology1 week ago

Technology1 week agoPerplexity takes on ChatGPT and Gemini with new Deep Research AI that completes most tasks in under 3 minutes – Crypto News

-

Technology1 week ago

Technology1 week agoLava Pro Watch X with 1.44-inch AMOLED display, in-built GPS launched in India at ₹4,499 – Crypto News

-

Technology1 week ago

Technology1 week agoMassive price drops on Samsung Galaxy devices: Up to ₹10000 discount on Watch Ultra, Tab S10 Plus, and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoPopular Investor Says Memecoin More Superior With ‘World’s Best Chart’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP To 3 Digits? The ‘Signs’ That Could Confirm It, Basketball Analyst Says – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar jumps to highs since December on USD weakness – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWho is Satoshi Nakamoto, The Creator of Bitcoin? – Crypto News

-

Business6 days ago

Business6 days agoWhat Will be KAITO Price At Launch? – Crypto News

-

Business6 days ago

Business6 days agoElon Musk’s DOGE Launches Probe into US SEC, Ripple Lawsuit To End? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Set To Outshine Gold? Analyst Predicts 1,000% Surge – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Price Pulls Back From Highs—Are Bulls Still in Control? – Crypto News

-

Technology3 days ago

Technology3 days agoStellantis Debuts System to Handle ‘Routine Driving Tasks’ – Crypto News

-

Technology1 week ago

Technology1 week agoBest phones under ₹20,000 in February 2025: Poco X7, Motorola Edge 50 Neo and more – Crypto News

-

others1 week ago

others1 week agoRemains subdued below 1.4200 near falling wedge’s lower threshold – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoYap-to-earn takes over Twitter – Blockworks – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago0xLoky Introduces AI-powered Intel for Crypto Data & On-chain Insights – Crypto News

-

Technology1 week ago

Technology1 week agoFactbox-China’s AI firms take spotlight with deals, low-cost models – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTether Acquires a Minority Stake in Italian Football Giant Juventus – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto narratives as we await next market move – Crypto News

-

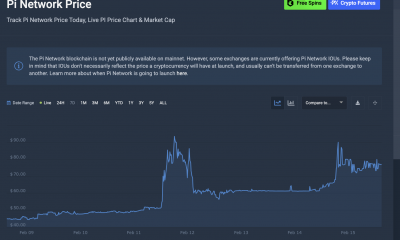

Business1 week ago

Business1 week agoHow Will It Affect Pi Coin Price? – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: JioHotstar launched, Sam Altman vs Elon Musk feud intensifies, Perplexity takes on ChatGPT and more – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGameStop Stock Price Pumps After Report of Bitcoin Buying Plans – Crypto News

-

Technology1 week ago

Technology1 week agoWhat will it take for India to become a global data centre hub? – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT vs Perplexity: Sam Altman praises Aravind Srinivas’ Deep Research AI; ‘Proud of you’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoNEAR Breaks Below Parallel Channel: Key Levels To Watch – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWill BTC Rebound Or Drop To $76,000? – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoXRP Price Settles After Gains—Is a Fresh Upside Move Coming? – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoHow AI will divide the best from the rest – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoHayden Davis crypto scandal deepens as LIBRA memecoin faces fraud allegations – Crypto News

-

Technology6 days ago

Technology6 days agoLuminious inverters for your home to never see darkness again – Crypto News

-

Business6 days ago

Business6 days agoWhales Move From Shiba Inu to FXGuys – Here’s Why – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSomeone Just Won $100K in Bitcoin From a $50 Pack of Trading Cards – Crypto News

-

Technology1 week ago

Technology1 week agoCyber fraud alert: Doctor duped of ₹15.50 lakh via fake trading app; here’s what happened – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI board unanimously rejects Musk’s $97.4 billion takeover bid: ‘Not for sale’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIs BTC Heading For $150K Rally? – Crypto News

-

Technology1 week ago

Technology1 week agoGrok 3 is coming! Elon Musk announces launch date, promises ‘smartest AI on Earth’ – Crypto News

-

Technology7 days ago

Technology7 days agoUnion Minister Ashwini Vaishnaw to launch India AI Mission portal soon, 10 companies set to provide 14,000 GPUs – Crypto News

-

Business6 days ago

Business6 days agoThese 3 Altcoins Will Help You Capitalize on Stellar’s Recent DIp – Crypto News

-

others6 days ago

others6 days agoForex Today: What if the RBA…? – Crypto News

-

Technology1 week ago

Technology1 week agoJioHotstar streaming platform launched, merging content from JioCinema and Disney+ Hotstar – Crypto News

-

Technology1 week ago

Technology1 week agoFormer Google CEO warns of ‘Bin Laden scenario’ for AI: ‘They could misuse it and do real harm’ – Crypto News

-

Technology1 week ago

Technology1 week agoSay goodbye to tangled cables: Stylish magnetic power banks keep your iPhone or Android charged on the go – Crypto News

-

Technology1 week ago

Technology1 week agoBest gaming mobiles under ₹20,000 in February 2025: Poco X6 Pro, OnePlus Nord CE 4 Lite and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Bullish Pennant Targets $15-$17 But Confirmation Is Required – Crypto News