![Yes [UNI] was king in 2022, but at what cost?](https://dripp.zone/news/wp-content/uploads/2022/12/Yes-UNI-was-king-in-2022-but-at-what-cost.jpg)

![Yes [UNI] was king in 2022, but at what cost?](https://dripp.zone/news/wp-content/uploads/2022/12/Yes-UNI-was-king-in-2022-but-at-what-cost-560x600.jpg)

Cryptocurrency

Yes [UNI] was king in 2022, but at what cost? – Crypto News

This year, the cryptocurrency market saw a significant decrease in value, losing over $1.4 trillion. This decline was due to various issues faced by the industry, including failed projects and a lack of liquidity.

The industry faced several challenges, with a number of prominent players within the ecosystem filing for bankruptcy, including BlockFi, Celsius, Voyager, Three Arrows Capitaland, more recently, ftx and Alameda.

The decentralized finance (DeFi) vertical suffered a similar decline as overall total value locked (TVL) – the total value of all assets held within a DeFi product – across all protocols plummeted by 77%. The reason behind the decline in DeFi TVL is not far-fetched.

A 35.51x hike on the cards if UNI hits ETH’s market cap?

In 2020, the US government implemented stimulus packages that resulted in an increase in the supply of US dollars, leading to higher demand and rising prices (inflation) in 2021.

However, in order to combat this rising inflation, the Federal Reserve raised interest rates in 2022. This made borrowing money more expensive and encouraged investors and consumers to reduce spending.

As a result, investors moved away from the speculative asset class (cryptocurrencies) to put their money in risk-free yields on US treasuries. This led to a severe decline in the value of several crypto-assets, the yield on DeFi investments, and DeFi TVL generally.

Uniswap’s various versions: A 2022 retrospective

Launched in 2018, Uniswap is a decentralized cryptocurrency trading protocol in which users can trade cryptocurrency assets.

The original version of the Uniswap protocol, known as Uniswap V1, was launched as a trial run to assess the effectiveness of the automated market maker (AMM) liquidity model. In May 2020, Uniswap V1 was replaced by Uniswap V2, which introduced numerous enhancements and new features to the platform.

Uniswap V3, launched in May 2021, quickly gained popularity in 2022 as it introduced a series of important upgrades to the DEX. This includes concentrated liquidity, flexible transaction fees, and range orders.

This series of upgrades introduced by Uniswap V3 led to its rapid adoption, which caused its TVL to grow significantly above the two previous versions. As per data from DeFiLlamaUniswap V3’s TVL of $2.45 billion represented a 74% share of total TVL for Uniswap.

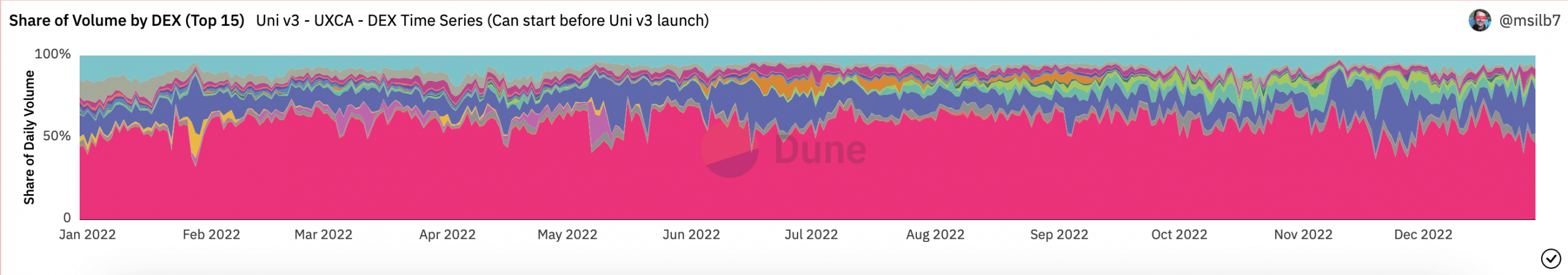

In 2022, Uniswap V3 quickly overshadowed DEXs that existed before it as increased usage led to a growth in its share of the total DEX trading volume.

how many UNIs you can get for $1,

As of January 2022, Uniswap V3 held a 39.4% share of total trading volume by DEXs, data from Dune Analytics revealed. By May, its share of total trading volume had peaked at 72%.

Interestingly, Uniswap V3’s position was threatened during the FTX debacle as other DEXs saw increased usage due to investors’ flight from centralized exchanges to DEXs. As a result, its share of total DEX trading volume fell to touch a low of 36.5% on 11 November. This was its lowest point throughout the 12-month period.

This rebounded not long after and was spotted at 46.5% as of 29 December. On a year-to-date basis, Uniswap V3’s share of the total DEX trading volume grew by 27%.

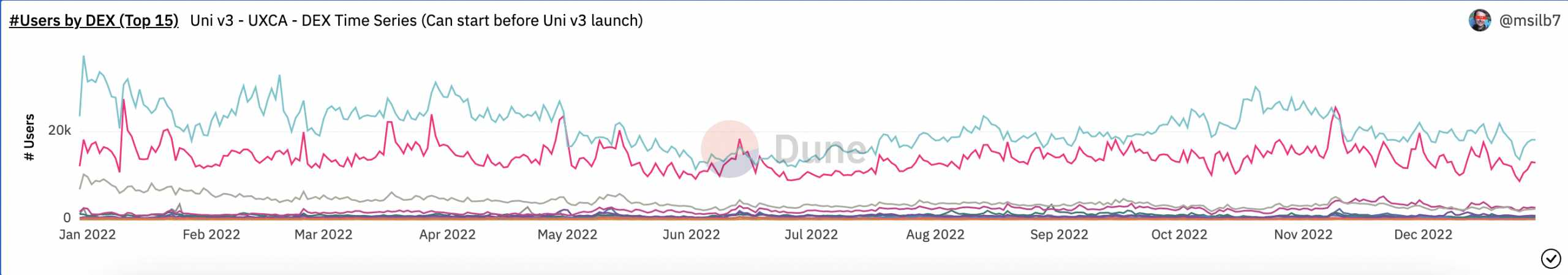

Uniswap V3’s high trading volume was attributable to the consistent growth in the count of its daily users. As per data from Dune Analytics, the steady growth in daily user count placed it atop all other DEXs as the DEX with the most everyday users.

When FTX collapsed, Uniswap v3 logged a daily high count of 25,552 users on 9 November. It saw the most influx of users from centralized exchanges amid the market turmoil caused by the unexpected FTX turmoil.

As of 29 December, Uniswap v3 had a daily user count of 12,949.

Despite the significant success recorded by its V3 deployment in 2022, Uniswap could not escape the impact of the severe bearishness that caused many DeFi protocols to register a decline within a 12-month period.

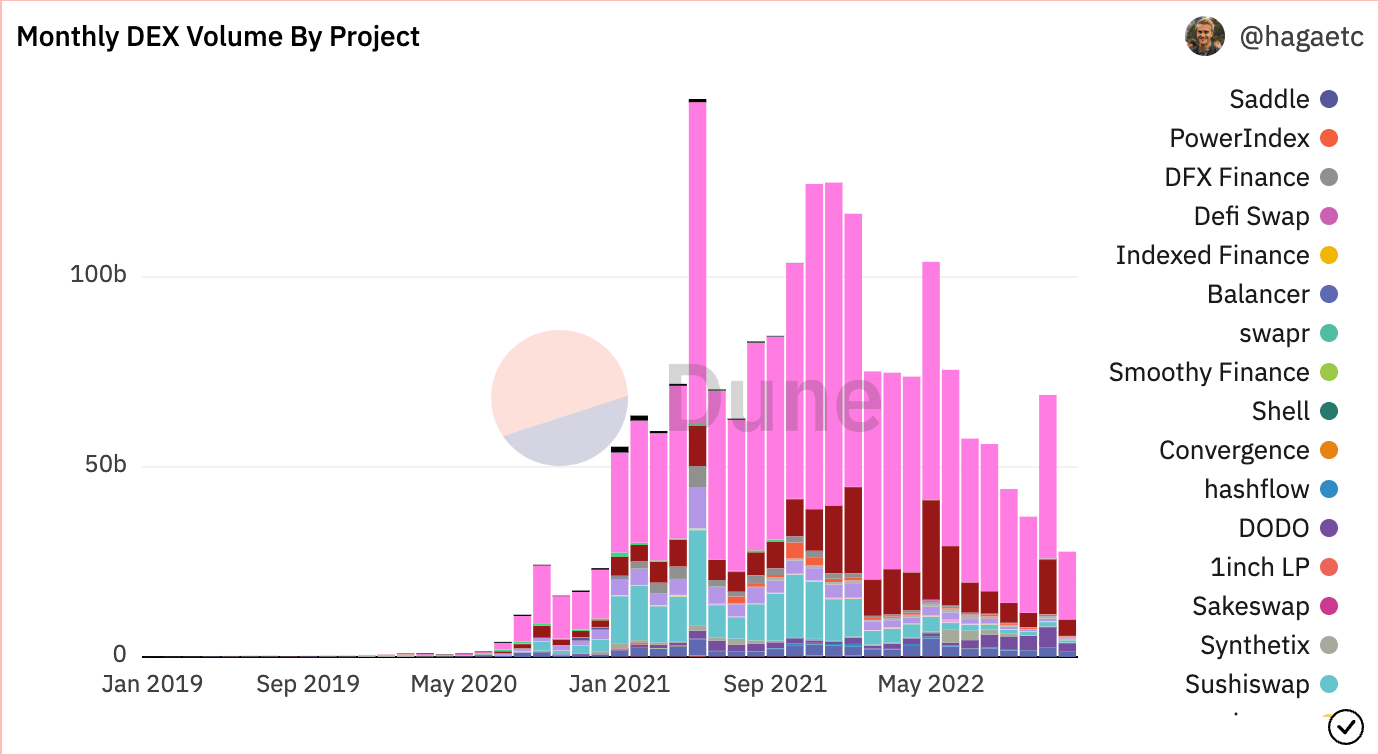

Uniswap’s monthly trading volume peaked in January when the DEX logged a trading volume of $71 billion. However, this declined steadily to $17 billion by December.

Uniswap: Key performance indicators in 2022

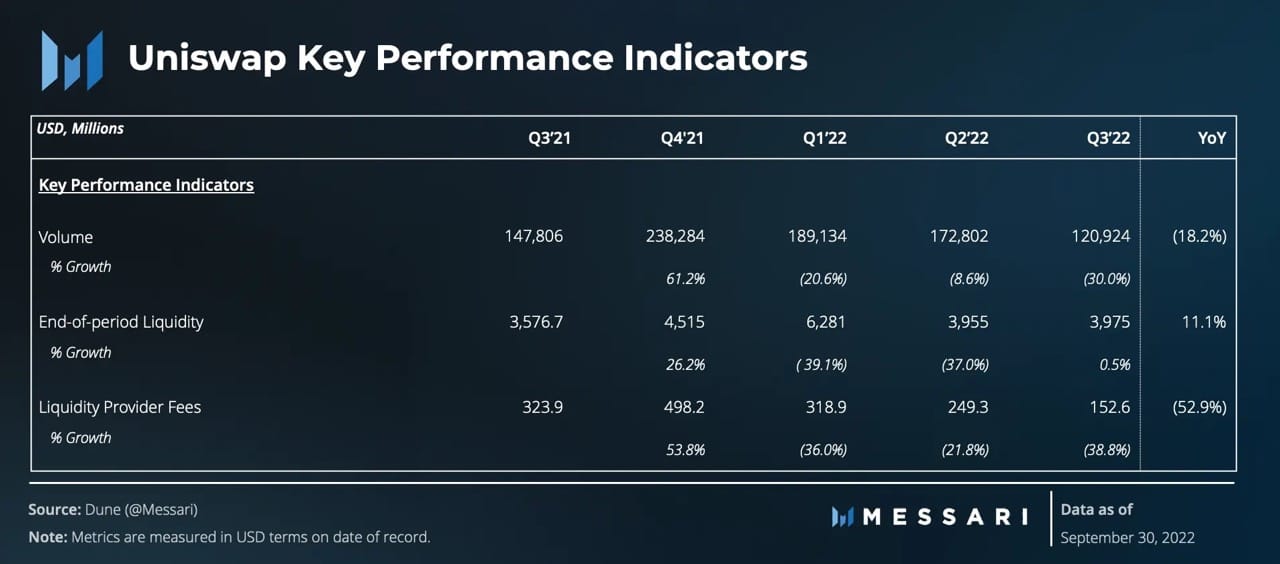

Uniswap saw a steep decline in trading volume in the first three quarters of the year. According to data from Messarithe leading DEX closed Q4 2021 with a trading volume of $238.28 billion.

By the end of Q1 2022 when the bear market became fully-fledged and investors began moving capital to US treasury bills, Uniswap’s trading volume had fallen by 21%. It closed the quarter with a trading volume of $189 billion.

Things didn’t get better in Q2. Terra Luna’s grave demise created a contagion that led to the collapse of several other players in the industry. Trading volume across DeFi protocols fell, and DeFi TVL declined further. Uniswap closed Q2 with a trading volume of $172 billion, an 8% decline QoQ.

This was followed by an even steeper decline of 30% in trading volume by the end of Q3, Messari reported.

In addition to a fall in trading volume, supplied liquidity on Uniswap fell as well. With end-of-period liquidity of $3.9 billion by the end of Q3, this had fallen by over half of its value since the beginning of the year.

Similarly, fees paid to liquidity providers on Uniswap fell throughout the year.

Source: Messari

uni had a tough time

UNI is a governance token for the Uniswap protocol, allowing holders to vote on changes to the protocol and participate in its decision-making processes. It is also used as a utility token within the Uniswap platform, allowing users to access certain features and services.

Towards the beginning of the year, the token was trading at $17.1, as per data from CoinMarketCap, This price level remains UNI’s highest selling price point during the 2022 bear market.

Exchanging hands at $5.01 at the time of writing, UNI’s value seems to have declined by over 71% in 2022.

concluding thoughts

Uniswap faced a difficult year due to a challenging macroeconomic environment, geopolitical uncertainty, and institutional liquidation. Although the DEX saw a decline in trading activity during the year, Uniswap strengthened its position in the crypto-industry by establishing an investment team and an NFT marketplace aggregator. These moves have positioned the protocol to continue to be a key player in the crypto-economy.

-

Blockchain6 days ago

Blockchain6 days agoInstitutional Demand Surges As Ethereum Sets New Inflow Records – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoDeFi Development Nears 1 Million Solana In Treasury – Crypto News

-

Business1 week ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAltseason heats up, but Bitcoin could face short-term pullback – How? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Technology1 week ago

“Decentralized Ponzi Scheme”- Gold Bug Peter Schiff Slams Landmark Crypto Bills – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCalifornia Sheriffs Believe 74-Year-Old’s Disappearance Linked to Son’s Crypto Fortune – Crypto News

-

Business6 days ago

Vitalik Buterin Approves Gas Limit Hike, Warns Against Risky Ethereum Scaling – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoStrategy to keep STRC Fund Pegged to $100 – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoZoho Zia LLM launched with speech-to-text models and AI agent marketplace: All you need to know – Crypto News

-

De-fi1 week ago

De-fi1 week agoBNB Chain Teases New Blockchain with Privacy Features to Compete With Crypto Exchanges – Crypto News

-

Technology1 week ago

Breaking: GENIUS Act Becomes First Major Crypto Legislation as Trump Signs Bill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoShytoshi Kusama Breaks Silence on New SHIB AI Whitepaper and Transformed Future – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoSanctum acquires Ironforge, plots transaction infrastructure vertical – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoXRP Price Hits All-Time High at $3.66 — Can It Smash Through $4 After Trump Win & SEC Shake-Up? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoHow to Use Google Gemini to Turn Crypto News Into Trade Signals – Crypto News

-

others6 days ago

others6 days agoEUR/CHF rises on speculation of SNB intervention, but EU–US trade risks cap gains – Crypto News

-

Technology5 days ago

Technology5 days agoGrab up to 43% off on best selling premium laptops from Apple, Asus and more – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency1 week ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Technology1 week ago

Technology1 week agoEurope’s answer to ChatGPT? Mistral adds voice and research features to Le Chat AI – Crypto News

-

De-fi1 week ago

De-fi1 week agoU.S. House Passes Clarity, GENIUS, and Anti-CBDC Acts With Historic Bipartisan Support for Crypto – Crypto News

-

Technology1 week ago

Technology1 week agoMalicious code found in fake coding extensions used to steal crypto – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP Price Spikes to Record Highs As Momentum Signals Extended Gains – Crypto News

-

Technology1 week ago

Technology1 week agoMeta’s AI Studio: Red flag or red herring? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhy Bitcoin self-custody is declining in the ETF era – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUS House passes three key crypto bills; market reaction muted as Bitcoin dips – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

others1 week ago

others1 week agoStreaming Service Handing $3,400,000 To Current and Former Customers To Settle Illegal Data Harvesting Allegations – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArthur Hayes-linked wallet bags $2M worth of AAVE and LDO in an OTC deal – Crypto News

-

others7 days ago

Why Is The Crypto Market Rising Today? – Crypto News

-

others6 days ago

Breaking: Polymarket Reenters US Market With Exchange Acquisition As Probe Ends – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoTo The Moon? Justin Sun To Be Launched Into Space After $28M Bid – Crypto News

-

others6 days ago

others6 days agoVenture Capital Firms Launch $360,000,000 Crypto Treasury Company Focused on Arthur Hayes-Backed Ethena (ENA) – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoEthereum Shatters Inflow Records, Pulls in $2.12 Billion in a Week – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoSolana Clinches 5-Month High, Where to From Here? – Crypto News

-

Technology5 days ago

BitOrigin Begins $500M Dogecoin Treasury With 40.5M Buy, Analysts Predict Fresh Bull Cycle – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoXRP Could Skyrocket 500% Against Bitcoin, Analyst Warns – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoCrypto Needs Minimum Viable Decentralization – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum price surges 6% to $2,800 as shorts suffer amid $500M crypto liquidation – Crypto News

-

Technology1 week ago

Technology1 week agoOnePlus Pad 3 with Snapdragon 8 Elite SoC makes its India debut, set to go on first sale in September – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: Fiscal dominance and super intelligence – Crypto News

-

De-fi1 week ago

De-fi1 week agoTrump’s Crypto Assets Now Comprise a Key Part of Family Fortune Worth Billions – Crypto News

-

Business1 week ago

Pi Coin Price Technical Analysis Confirms Buy Signal Despite 2M Exchange Inflows – Crypto News

-

Technology1 week ago

Technology1 week agoNot Google or Bing! This search engine lets you block AI images in search results – Crypto News

-

Cryptocurrency1 week ago

GENIUS Act Is The Catalyst For XRP And RLUSD’s Dominance, Expert Declares – Crypto News