others

S&P/TSX 60 Index Elliott Wave technical analysis [Video] – Crypto News

S&P/TSX 60 Elliott Wave technical analysis – Day chart

Function: Bullish Trend.

Mode: Impulsive.

Structure: Orange wave 1.

Position: Navy blue wave 3.

Direction next lower degrees: Orange wave 2.

Details: Navy blue wave 2 appears complete; orange wave 1 of wave 3 is developing.

Invalidation level: 1339.

The daily Elliott Wave analysis for the S&P/TSX 60 indicates a bullish trend supported by impulsive price action. The current structure shows orange wave 1 forming within navy blue wave 3, signaling the onset of a broader upward trend. The next lower-degree movement expected is orange wave 2, a corrective pullback likely to follow wave 1’s completion.

Analysis shows navy blue wave 2 has concluded, and orange wave 1 is now advancing. This development supports growing bullish momentum and the potential for further upward movement. If the price drops below 1339, the wave count becomes invalid, requiring a re-evaluation of the trend.

The impulsive wave structure reflects increased buying strength, with the invalidation level of 1339 serving as a vital support level. As long as the price remains above this mark, the bullish setup remains intact. Traders are advised to monitor for the end of orange wave 1 and prepare for orange wave 2’s retracement before a potential rise in wave 3 resumes.

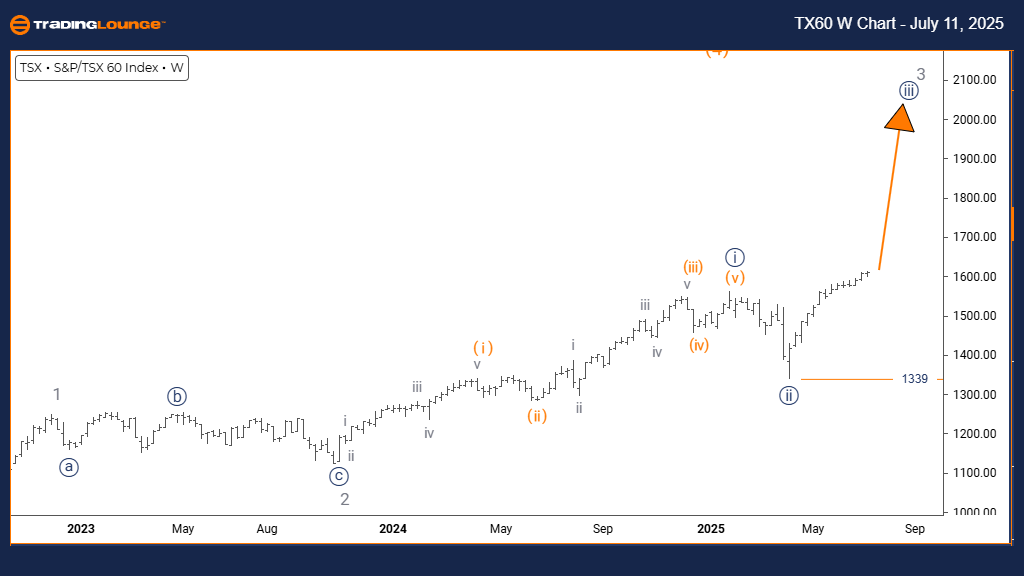

S&P/TSX 60 Elliott Wave technical analysis – Weekly chart

Function: Bullish Trend.

Mode: Impulsive.

Structure: Navy blue wave 3.

Position: Gray wave 3.

Direction next lower degrees: Navy blue wave 4.

DETAILS: Navy blue wave 2 appears complete; navy blue wave 3 of gray wave 3 is active.

Invalidation Level: 1339.

The weekly chart of the S&P/TSX 60 index reveals a strong bullish trend using Elliott Wave analysis. The chart identifies navy blue wave 3 within a larger gray wave 3, highlighting an impulsive upward movement. The next anticipated structure is navy blue wave 4, which typically represents a brief corrective phase before the continuation of the trend.

Based on the analysis, navy blue wave 2 has likely finished, and wave 3 is in progress, indicating rising bullish momentum. A drop below the 1339 level would invalidate the current wave count and prompt a reassessment of the market’s direction.

The impulsive price action signals sustained buying strength, reinforcing the bullish narrative. Traders should track the evolution of navy blue wave 3, watching for signs of its completion and the beginning of wave 4. The invalidation point at 1339 remains a critical marker to uphold this trend view.

This framework aids traders in forecasting potential price moves and making strategy adjustments. As long as prices stay above the invalidation level, the outlook remains positive for further gains in the S&P/TSX 60 index.

S&P/TSX 60 Index Elliott Wave technical analysis [Video]

-

Metaverse1 week ago

Metaverse1 week agoWhat Satya Nadella’s latest shakeup says about Microsoft’s evolving AI strategy – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhat Satya Nadella’s latest shakeup says about Microsoft’s evolving AI strategy – Crypto News

-

Technology1 week ago

Breaking: China Renaissance Bank Eyes $600M Raise for BNB-Focused Fund with YZI Labs – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoStripe’s stablecoin biz seeks national bank trust charter – Crypto News

-

Technology1 week ago

Technology1 week agoAI isn’t the dot-com bubble, but that won’t stop it from ending badly – Crypto News

-

Technology1 week ago

Technology1 week agoBest phones under ₹15,000: Oppo K13 5G, Infinix Note 50s, iQOO Z10x and more – Crypto News

-

others1 week ago

others1 week agoEUR/JPY retreats as Euro slides on French political uncertainty – Crypto News

-

Metaverse1 week ago

Metaverse1 week agohuman intelligence for artificial minds – Crypto News

-

others1 week ago

others1 week agoChina’s Commerce Ministry urges US to correct its wrong practices as soon as possible – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT will soon pay for you! India’s AI payment pilot set to go live: What it means for users – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Traders Show ‘Rationalization’ Behavior’ After Market Plunge – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Bitcoin could rebound up to 21% this week: experts explain – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoShiba Inu Burn Rate Crashes 99% as Crypto Sees Largest Liquidation Event Ever – Crypto News

-

others1 week ago

others1 week agoTrump’s tariff threat pushes US Dollar below 99 amid trade tensions – Crypto News

-

others1 week ago

others1 week agoWhich way out of the range – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow Solana Overtook Ethereum’s Early Growth Curve – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto liquidations drive historic market turbulence – Crypto News

-

others1 week ago

Peter Brandt Flips Bullish on Bitcoin, Ethereum, XRP, and XLM – Crypto News

-

others1 week ago

others1 week agoA balanced approach to monetary policy only works if inflation expectations are anchored – Crypto News

-

others1 week ago

Binance Founder CZ Addresses BNB’s Recent Strong Price Performance, Says It Has No Market Makers – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoWalmart teams with OpenAI for ChatGPT purchases. The retailer is ‘ahead of the curve’. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoThe Latest Nobel Peace Prize Winner Is a Bitcoin Supporter – Crypto News

-

De-fi1 week ago

De-fi1 week agoDeFi Withstands Stress Test as Market Mayhem Wipes Out Nearly $20B – Crypto News

-

Technology1 week ago

Fed’s Anna Paulson Backs Rate Cuts, Downplays Trump Tariff Impact – Crypto News

-

Technology6 days ago

Technology6 days agoApple launches MacBook Pro 14-inch with M5 chip in India, price starts at ₹1,69,900 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHow to Use ChatGPT to Discover Hidden Crypto Gems – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPolymarket bets trigger Nobel leak probe in Norway – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow Crypto Traders Are Positioning Following ‘Black-Friday’s’ Crash – Crypto News

-

others1 week ago

Crypto Market Braces for Volatility Ahead of Key U.S. Economic Events This Week – Crypto News

-

Technology1 week ago

XRP Price Crashes as Whales Dump 2.23B Tokens — Is $2 the Next Stop? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago$23 Billion XRP Milestone Spotlighted by CME Group: Details – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPowell speech steadies crypto market: Fed hints at slower balance-sheet runoff – Crypto News

-

Business7 days ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Business7 days ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDecoding WLFI’s meltdown – Can a $7mln buyback undo a $190mln dump? – Crypto News

-

Technology1 week ago

Technology1 week agoHow to create 90’s retro-style Diwali AI portraits with Google Gemini Nano: 50 Viral prompts to try – Crypto News

-

Business1 week ago

Crypto Market Recovery: BTC, ETH, XRP, DOGE Surge 4-12% As Expert Sees V-Shape Upside – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIs It Good to Invest in Ripple Now? – Crypto News

-

Technology1 week ago

Technology1 week agoAMD strengthens AI push: Oracle to deploy 50,000 MI450 AI chips in data centers starting 2026 – Crypto News

-

others7 days ago

others7 days agoSeems ‘prudent’ to cut rates further given lower inflation risks – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoBeyond Bitcoin: How Asia’s new crypto playbook is breaking from the west – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoCelestia price reclaims $1 after crash to $0.27: TIA forecast – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoChatGPT ‘adult model’ plan: OpenAI’s Sam Altman reacts to criticism, says ‘not elected moral police’ – Crypto News

-

others1 week ago

others1 week agoGBP/USD hits a two-month low as UK fiscal concerns weigh – Crypto News

-

Technology1 week ago

Technology1 week agoGemini Nano Banana model now generates and edits images inside Google apps: How it works – Crypto News

-

![Car Group Limited – CAR Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Car-Group-Limited-–-CAR-Elliott-Wave-technical-analysis-Video-400x240.jpg)

![Car Group Limited – CAR Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Car-Group-Limited-–-CAR-Elliott-Wave-technical-analysis-Video-80x80.jpg) others1 week ago

others1 week agoSamsara Inc. (IOT) laps the stock market: Here’s why – Crypto News

-

others1 week ago

Four Meme and BNB Partner on $45M ‘Rebirth Support’ Airdrop, First Batch Set to Begin – Crypto News

-

Metaverse7 days ago

Metaverse7 days ago‘Erotica for verified adults’: OpenAI to allow mature content on ChatGPT; Sam Altman vows to treat adults like adults – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoBitcoin, Ethereum rebound following ‘largest single-day wipeout in crypto history’ – Crypto News

-

Business6 days ago

Nasdaq-Listed Webus Adopts XRP in New Tokenized Reward Platform, Eyes $20B Loyalty Market – Crypto News